According to statistics, more business are likely to fail instead of succeeding as was intended due to a myriad of reasons, the most common here being mishandling of finances. Mishandling of finances does not necessarily mean using business money for personal expenses because they include the accounting mistakes that most of them make over the years resulting in cash flow problems, shrinking profits, and overwhelming debt as highlighted by this website. Since small business owners are likely to make these common accounting mistakes, getting to know more about them on this page will give them a chance of success. Below are the common accounting mistakes to steer clear of to ensure the success of your firm.

Ignoring finances is the most common accounting mistake among small business owners; failure to manage business finances is likely to worsen the situation, that is why it should be done as regularly as possible even though it is a tedious and time-consuming task. Avoid mixing business with personal finances to increase the chances of its success; all the finances pertaining to the business should be in a small account separate from your personal finances to avoid mixing the two.

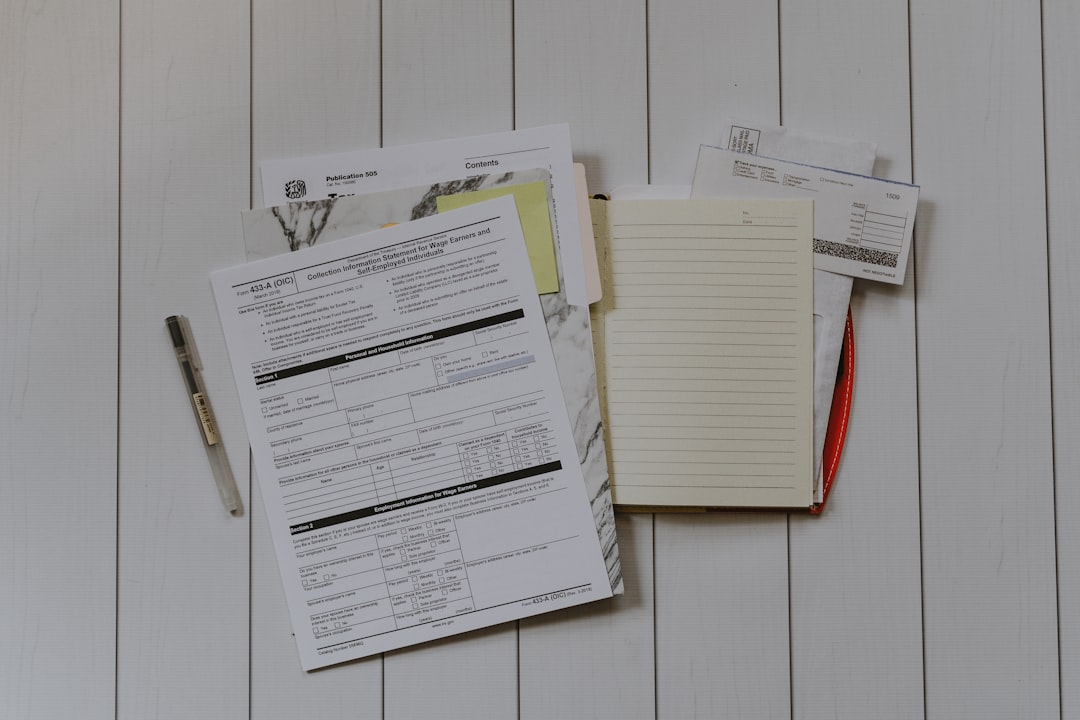

Another accounting mistake that is common among small business owners is the failure to keep financial documents; all the business financial records should be kept for at least seven years, and will come in handy during filing of taxes and record keeping. An important aspect of keeping an eye on the business finances is tracking all the expenses; it may be frustrating and time-consuming, however, you will never regret creating and following a budget.

Among the accounting mistakes that new small business owners make is the failure to back up data; if you have hard copies of all your financial documents, you should consider having digital copies too in case of an accident like fire or flood or something goes wrong. Keeping digital copies of the financial documents comes with several benefits that you shouldn’t think twice about it; the idea of knowing your financial documents are safe quite reassuring.

Business owners are hiring experts because they know how tedious it running a business alone can be, and the sooner you understand that and outsource the services you need, the better off you will be. Hiring experts allows you to access the expert services for a fraction of the cost, saving on the cost of recruiting, training, acquiring equipment, and technology among other things. Now that you are familiar with the accounting mistakes to avoid, it is time to give your business a chance at success by doing everything right.

Supporting reference: check my source